3 min read

Honchō Scoops Up Two UK Search Awards!

It’s official, we've added not one, but two shiny trophies to our awards cabinet! We’re over the moon to share that we’ve triumphed at the UK Search...

After the release of a recent report from Pi Datametrics, our Senior Account Executive, Mellisa, delves deeper into how retailers are expected to perform on Black Friday 2018.

Yes folks, it’s that time of year again! Christmas is just around the corner, and with it comes one of the most anticipated trading events of the year – Black Friday.

Made popular in the UK in 2013, Black Friday has become an event that we hate to love. And yet, we all put the date in our diaries so that we can make the most of those irresistible bargains just in time for Christmas. Last year’s figures speak for themselves, proving the trading event to be a huge success.

In 2017, UK shoppers spent £1.4bn online on Black Friday, an 11.7% increase on the previous year. With more retail opportunity in the UK for Black Friday than at any other time during the year, particularly online, there has never been more reason for retailers to optimise their Black Friday strategies.

A recent report from Pi Datametrics reveals that of those businesses who took part in Black Friday 2017, 92% of them saw an increase in the number of visitors to their website, and a further 71% saw an increase in sales. And with approximately 2,240,000 hits, the search term ‘Black Friday 2017’ was by far the most popular Google search.

“In 2017, UK shoppers spent £1.4bn online on Black Friday, an 11.7% increase on the previous year.”

Despite the fact that these figures clearly demonstrate the sheer scale of success Black Friday has brought for most retailers, many businesses still face a huge challenge that will make them lose out on a golden opportunity. How can retailers boost brand exposure and target a sizeable amount of traffic without the need for expensive and overrated marketing campaigns?

Five years on and even the biggest of retailers are still struggling to fight for visibility on their brands for ‘Black Friday’ related search queries. Why? Because they have failed to optimise their Black Friday strategies to satisfy the user journey over the search intent, as traffic takes on a more ambiguous journey during massive sale events.

Targeting specific search terms like ‘Black Friday laptop deals’ or ‘Black Friday sofa deals’ does not work as effectively as you may have thought. Branded and product specific terms satisfy a significantly lower value in organic traffic when compared with ‘Black Friday general terms’. From November 2015 to 2017, ‘Black Friday general’ terms increased by 66%, becoming the most searched for terms on Black Friday. Therefore, it would make sense to optimise retail campaigns using these most searched for terms.

“How can retailers boost brand exposure and target a sizeable amount of traffic without the need for expensive and overrated marketing campaigns?”

‘Shop’ terms saw success from November 2015 to 2016 with a 56% increase in search volume. However, the uplift in search volume did not last and fell by 28% the next year, possibly as a result of retailer-specific promotions no longer available in 2017. ‘Black Friday general’ terms were unaffected and continued to increase and are predicted to do the same this year.

What can we learn from consumers’ shopping behaviour on Black Friday 2017? Earlier this year, the KMPG Annual Retail Survey 2018 reported that 97.5% of all goods bought during the event were discounted, 67.5% of which were reduced by as much as 30%. Despite the fact that 76.6% of purchases were made online last year, 12% of online shoppers admitted that they visited a store to try on the products before proceeding to buy them online.

But what does all this mean for Black Friday 2018? Black Friday will always take centre stage on the UK shopping calendar, but in a world of uncertainty thanks to the disruptive forces of Brexit, we may just find that both high street and online retailers will see their sales stagnate this year. However, shoppers will continue to migrate from the high street in favour of making purchases online.

Black Friday could well be a let-down this year, perhaps not in terms of the deals available, but because of consumers’ sheer reluctance to part with their money. October saw yet another decline in spending in a sign that economic growth is slowing for the final months of the year. Consumer spending declined by 0.2% year-on-year, which sees the first drop in three months. Now that we head into the key Christmas shopping period, this makes for disappointing news for both high street and online retailers.

“…in a world of uncertainty thanks to the disruptive forces of Brexit, we may just find that both high street and online retailers will see their sales stagnate this year.”

Industry watchdogs have urged shoppers to look at pricing as well as the saving they are likely to make. And with 47.2% of purchases made outside of the Black Friday trading event in 2017, retailers can expect a drop in impulsive purchases this year as consumers scope out all options and compare the prices available before following through with a purchase.

Every year the hype around Black Friday forces retailers to apply heavy discounts to their stock in a bid to stand out against their competition, and this year will be no exception. Retailers will see their profits and margins squeezed further than ever before in a bid to avoid seeing their brand name on the list of companies facing administration in January 2019. Come December, we can expect to hear that many of our favourite retailers are facing serious trouble having underperformed during Black Friday.

Another dip in electronic goods sales is forecasted this month after retailers witnessed a 25% drop during Black Friday 2017. Smaller purchases accounted for the majority of Black Friday purchases last year, with health and beauty, clothing and shoes topping the list of the most popular internet purchases. The same can be expected this year, however, it is unlikely that we will see more than a 3% uplift in sales in these products.

With this year’s Black Friday event comes an air of change: the uncertainty of Black Friday sales in years to come. Is this year the last time we’ll see a Black Friday event? Are consumers rejecting the fixed periods where they are expected to part with their hard-earned cash? No one really knows the answer, but it’s all the more reason to make your brand stand out this coming Black Friday.

For many retailers, Friday 23rd November 2018 brings with it a number of hurdles that, if approached correctly, could make all the difference between a profitable trading event and yet another record-breakingly disappointing quarter sales report. But what are the biggest challenges that retailers face this coming Black Friday?

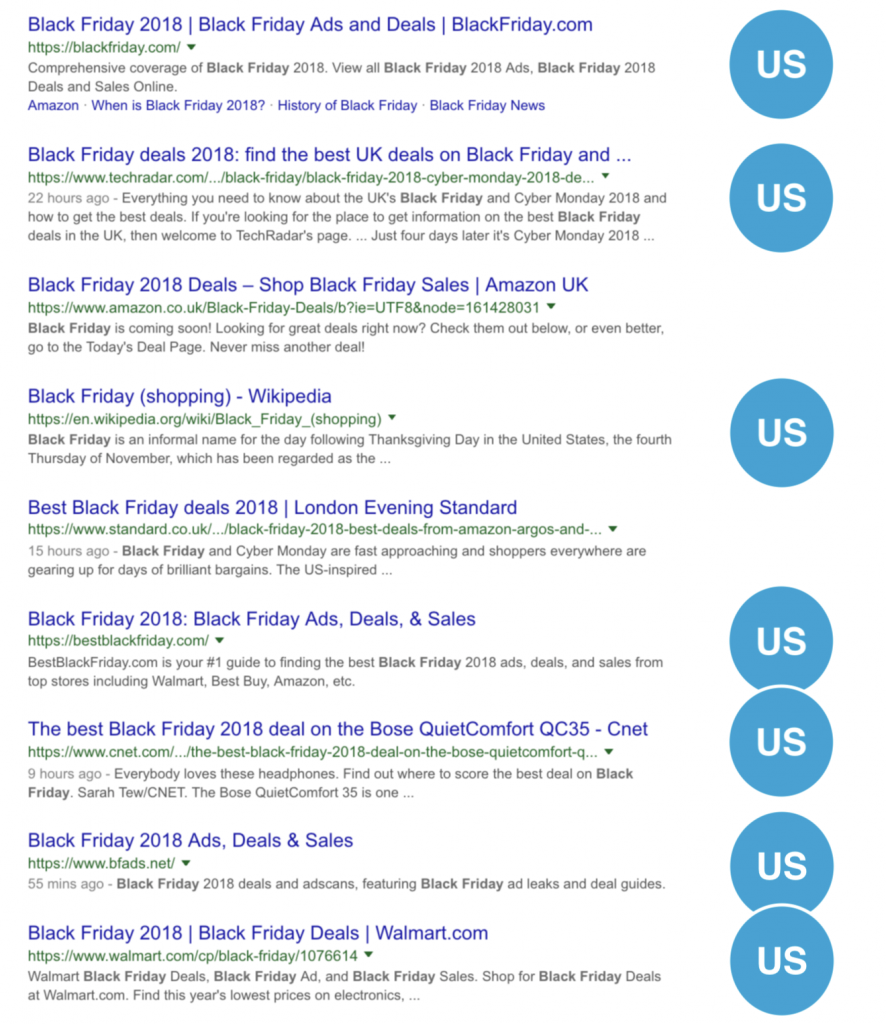

When it comes to appearing against US results for ‘Black Friday’ search queries, most UK retailers fail to make it onto page one in Google UK. In fact, the SERPs are dominated by US retailers and publishers, which fails to satisfy the user intent of someone searching from the UK. But it’s not just UK brands that are failing to optimise their sites, many of their American counterparts are making the same mistakes.

7 search results out of the top 9 sites featured in Google SERPs are ranking outside of their US market for the term ‘Black Friday’. Many of these websites also appear when searching for ‘Black Friday deals’, which only emphasises the need for a crucial research stage to identify the trends in keywords to give UK retailers an edge over US based brands.

{Image Credit: screenshot}

The sheer lack of visibility for UK retailers means that a large proportion of organic traffic is not being monopolised, ultimately hindering the user’s journey due to the lack of .co.uk sites that are accessible when searching for terms like ‘Black Friday’ and ‘Black Friday deals’. And of those UK sites that do appear, a large majority of them are publishers, which still defers the user away from their intended search intent.

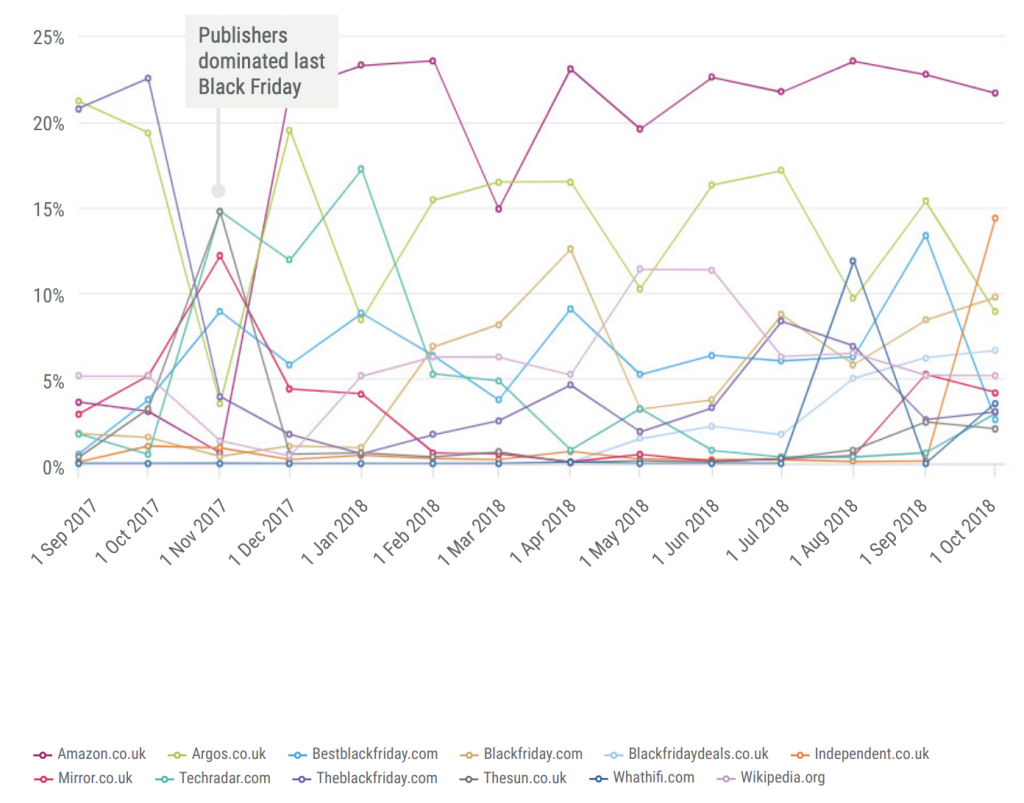

It’s not just US brands that UK retailers face themselves competing against for the top spot in page one. UK publishers also present a challenge for many brands. Online newspapers and magazines took over the top positions in Google in November 2017, which was held by retailers only two months prior.

{Image Credit: Pi Datametrics}

Dominating information-based searches, national and local publishers won valuable traffic for ‘Black Friday general’ terms that many retailers were not appropriately optimised to target. They used fresh content to cover Black Friday as the event unfolded throughout the day, usurping retailers and affiliates at the last minute when it really counted. Retailers were unable to hold their positions to due to a lack of reactive content on their sites.

This is evidence enough that retailers must track their performance down to the very last hour on Black Friday, in order to have the opportunity to respond to any changes in organic traffic. Implementing reactive content as a means to remedy a loss in traffic will increase the opportunity of recovering any fall in positions in the SERPs.

There’s no denying that Black Friday presents an exceptional opportunity for UK retailers. However, it is important to devise a commercially valuable content strategy to coincide with the brand’s business strategy. Applying this search data to both strategies will enable any retailer to produce a long-term Black Friday strategy that will see the brand maintain a strong position throughout the build up to and during the event.

Getting ahead of the competition involves planning early – a year in advance in fact! Start by planning your strategy around the top 10 most valuable keywords from the previous year, as demonstrated in the table below, during times of low search interest. Doing so will enable you to build visibility over a long period of time to ensure that you are more likely to rank during Black Friday. You can then action a content plan to target these keywords throughout the year and factor them into your Black Friday PCC strategy.

*2017 keywords will need to be updated to 2018

Leaving it to the last minute to influence consumers can only ever end badly. Instead, take advantage of consumer engagements and insights using data collected from email marketing, promotions and cookie pools. It’ll make it easier to understand what consumers are more receptive too and what their user intent is likely to be leading up to the big event. With this information, your content strategy can evolve accordingly to take these findings into consideration.

There’s no better way to make your site peak when there’s high search demand by building relationships with the competition. Affiliates and publishers can help to promote your products and your brand during the lead up to and on Black Friday. And if these sites do end up peaking for ‘Black Friday general’ terms, your site will still see an uplift in traffic by association because of the reactive content.

Leaving your content to the last minute just won’t do. Preparation is the key to success for most trading events, so it is important that you take the time to analyse your data from the previous year. This will enable you to create a content strategy that communicates effectively with a wider audience that you may not usually cater for. Plan your content to capture your audience’s need for information, brand awareness and regular news updates.

There is no doubt amongst the retail industry that Black Friday 2018 is likely to be the last saving grace for big brand names, both in the high street and online. With the new year comes yet more uncertainty for consumers and retailers alike, as the economy is threatened by the effects of Brexit. Who knows what next year will bring?

For some retailers, the results of Friday 23rd November, and indeed Christmas, may well mean the end of their brand. And of those who surpass the new year, it will forewarn whether or not they will survive 29th March 2019. Only time will tell…

Connect with me on LinkedIn or tweet @Honcho_Search and let me know your thoughts on Black Friday. Until next time…

3 min read

It’s official, we've added not one, but two shiny trophies to our awards cabinet! We’re over the moon to share that we’ve triumphed at the UK Search...

5 min read

Understand ecommerce attribution models which attribution models can maximise your marketing efforts and ROI.

3 min read

Explore how social commerce is changing the way we shop online, blending social interactions with digital commerce for a seamless buying experience.